UCSB's Economic Forecast Project Summit Analyzes World, National, Santa Barbara County Economies

I'm optimistic, said Peter Rupert, professor and chair of economics at UC Santa Barbara, during his presentation at the 2013 Santa Barbara County Economic Summit. The first session of the two-day event, held annually by UCSB's Economic Forecast Project, took place at the Granada Theatre in Santa Barbara.

Despite the official ending of the Great Recession by the National Bureau of Economic Research in 2009, business, industry, and households across the country are still struggling with a slow and steep climb out of the worst national financial disaster in recent history. The economy is undergoing a "slow and steady recovery" across the nation, though the growth is not uniform, said Rupert, who is also the director of the Economic Forecast Project.

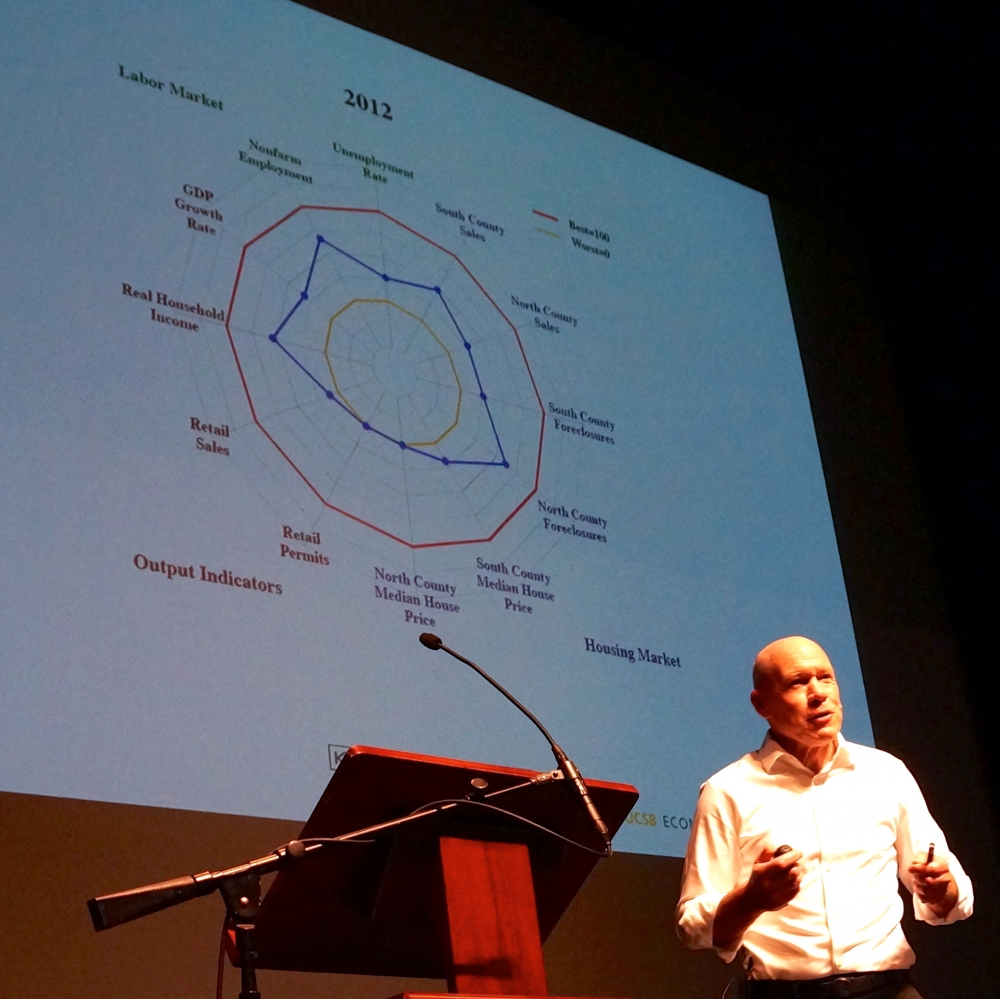

In terms of output, national gross domestic product is recovering slowly. Santa Barbara's GDP is "doing well," according to Rupert, given that it was somewhat cushioned from the sharp rise and fall felt elsewhere in the country. Household income, however, shows a slightly negative trend. Meanwhile, consumer spending has increased, and retail sales have, on average, increased in Santa Barbara County, with the largest growth occurring among gasoline stations and furniture and home furnishings.

In terms of jobs, nationwide unemployment is improving, albeit at a very slow rate. In 2010-11, Santa Barbara County's employment experienced the first positive growth since the recession –– 1.8 percent. According to Current Employment Statistics, 2012 was a stronger year.

"People are getting back to work," said Rupert. The county's smallest sectors –– mining and information technology –– experienced the largest growth, while the county's largest sector –– government –– experienced no growth.

The housing market in the United States, according to the report, "has shown a lot of improvement. In Santa Barbara County, home prices have not yet rebounded as expected; however home sales, especially in the South County, are "off the charts."

Rupert's talk was preceded by discussions on the national and international economy, presented by the Economic Forecast's featured speakers. Neil Barofsky, the first special inspector general of the Troubled Asset Relief Program (TARP), recounted his experience witnessing "with detached horror" the financial debacle brought on by lowered lending standards, and risky and complicated financial products. Barofsky, author of the book, "Bailout: How Washington Abandoned Main Street While Rescuing Wall Street," also recalled what he saw as an unsuccessful attempt at recovery –– the $700 billion TARP program –– and relatively few consequences for banks and regulators for the entire disaster.

"‘Too big to fail' became ‘too big to jail'," Barofsky remarked.

Thomas Cooley, professor of economics at New York University and a widely published scholar in the areas of macroeconomic theory, monetary theory and policy, and the financial behavior of firms, discussed the Eurozone crisis, a sovereign-debt predicament that he said "will continue to provide headwinds to the US economy," given that the EU is the U.S.'s largest trading partner.

Douglas Elliot, a fellow in Economic Studies at the Brookings Institution, was the self-described "optimist" of the guest speakers. For all its flaws, global financial reform is moving forward, he said, predicting government intervention more frequently. Regulation is a balancing act; the better the protection, the less available loans and credit would be, he said.

Day two of the summit takes place in Santa Maria on Friday, May 3. Rupert will present the North Santa Barbara County outlook, while Economic Forecast Project research analyst Bonnie Queen discusses demographic data. Cooley reprises his talk on the Eurozone crisis, while Rod Alferness, dean of UCSB's College of Engineering, will discuss technology in Santa Barbara County.

Sponsors for this year's Economic Forecast Project include Union Bank, Montecito Bank & Trust, Chase, and Bank of America.

Related Links